The Wall Street Code explores the once-secret lucrative world of prolific algorithmic trading by profiling an inside programmer who, in 2012, dared to stand up against Wall Street and its extreme culture of secrecy, to blow the whistle on insights into the way the modern global money market works. His name is Haim Bodek—aka 'The Algo Arms Dealer'—and having worked for Goldman Sachs, his revelations speak to the new kind of wealth made only possible by vast mathematical formulas, computer technologies and clever circumventions of laws and loophole exploits. Vast server farms and algorithms working beyond the timescale of human comprehension, have largely taken over human trading on the global financial markets for decades. What are the implications of that? The algorithms seem to have a life of their own. Snippets of code secretly lie waiting for the moment that your pension fund gets on the market; trades done in nanoseconds on tiny fluctuations in stock prices. And the only ones who understand this system are its architects—the algorithm developers. The Wall Street Code provides just a small insight into this new world of high-frequency trading, amongst other things...

Perfect Storm offers an initial analysis of the underlying causes and wider context surrounding the riots throughout England in 2011. Contrary to the portrayals presented by mainstream media and trite political rhetoric around law and order, the riots were sparked by poverty, inequality and frustration over police killing a young man in Tottenham. How does the damage weigh up to the criminal conduct of banks and corporate tax avoiders when the costs of the riots are over four thousand times less than the recent financial crisis? Whose priorities are at play here?

The Power of the Fed investigates how the United States central bank's actions have played out over the years on Wall Street versus Main Street, since the last financial crash of 2008. The film traces how the experiment the Fed began in 2008 has been dramatically ratcheting up, peaking with the COVID-19 crisis in 2020. But, of course, rather than help correct from the huge corruption and financial abstractions that caused the 2008 crash, the fed has doubled down on its policies of "quantitative easing" which have gone on to help widen the greatest inequality of wealth in history, pushing financial products even further removed from the economy, driving inflation, automation, and worsening the impending cycles of boom and bust. The rise of speculative cryptocurrencies and non-fungible tokens (NFTs) has only fueled the mania, as economic volatility increases.

Far from ending with the abolition of slavery, the trade in human beings is thriving more than ever before. Today, 27 million men, women and children are held, sold and trafficked as slaves throughout the world. From the sex slaves of Eastern Europe to China's prison labour slaves; from Brazil's hellish charcoal slave camps to entire families enslaved in Pakistan's brick kilns, this series exposes the people behind modern slavery and the companies who profit from it.

Did you know that the legal system recognises a corporation as a person? What kind of 'person' is it then? What would happen if it sat down with a psychologist to discuss its behaviour and attitude towards society and the environment? Explored through specific examples, this film shows how and why the modern-day corporation has rapaciously pressed itself into the dominant institution of our time, posing big questions about what must be done if we want a equitable and sustainable world. What must we do when corporations are psychopaths?

In Requiem for the American Dream, renowned intellectual figure Noam Chomsky deliberates on the defining characteristics of our time—the colossal concentration of wealth and power in the hands of the few and fewer, with the rise of a rapacious individualism and complete collapse of class consciousness. Chomsky does this by discussing some of the key principles that have brought this culture to the pinnacle of historically unprecedented inequality by tracing a half century of policies designed to favour the most wealthy at the expense of the majority, while also looking back on his own life of activism and political participation. The film serves to provide insights into how we got here, and culminates as a reminder that these problems are not inevitable. Once we remember those who came before and those who will come after, we see that we can, and should, fight back.

Six years after the housing bubble burst in the United States in 2008, the worst is yet to come. After a recent landmark settlement, major banks have lifted the freeze on foreclosures, with evictions again in full swing. Public housing budgets have been slashed, while the thin line between home ownership and homelessness grows ever more wide. People are angry about the impunity of the banks and some have found innovative ways of fighting back in an age of austerity. For Sale travels to Chicago and California to see how people at the forefront of the crisis are confronting the collapse of the American dream.

The Secret History of the Credit Card uncovers the deceptive techniques and tactics used by banks and financial corporations to get citizens to take on ever more debt, while earning record profits. Penalty fees, defaulting, changing contracts, increasing rates retrospectively---these are some of the ways credit card companies gouge their users, and increase influence. The film shows how such profitability of credit cards began in the 1980s, when the banking industry successfully eliminated the limit on the interest rate a lender can charge a borrower. This deregulation, coupled with real-time tracking of personal financial information, facilitated the widening availability of credit cards. Despite a growing number of consumer complaints, the ability of state and local governments to investigate the credit card companies has virtually been eliminated, due to companies incessant lobbying and litigation that has created a jurisdictional "turf battle."

For more than two years the Eurozone has teetered on the edge of an economic precipice. But how exactly did it get into the current financial mess? Talking to historians, economists and politicians, The Great Euro Crash takes a long view of the euro--from Churchill's vision of a United States of Europe; to the bail-outs of Greece, Portugal and Ireland. Meeting a property developer in Ireland, a taxi driver in Rome and a German manufacturing worker; the film exposes the high cost being paid by European workers today for the dream of European Union—how the entire system has so far come to a complete banking meltdown. The crisis could yet claim Britain, with its vast financial sector, dragged down by the collapse of the euro. And the cost of reviving the complex economy is so high, triggering a return to the economic mayhem of the 1930s.

Money is a new form of slavery and is only distinguishable from the old slavery simply by the fact that it is impersonal--that there is no human relation between master and slave. Debt in government, corporate and household has reached astronomical proportions. Where does all this money come from? How could there be that much money to lend? The answer is that there isn’t...

Nearly 100 years after its creation, the power of the United States Federal Reserve has never been greater. Governments and financial systems around the world pay close attention to the Fed Chairman's every word, philosophies and ideologies. Yet the average person knows very little about the most powerful and least understood financial institution. Money For Nothing takes viewers inside the Fed and reveals the impact of Fed policies past, present, and future.

The End of Poverty? traces the growth of global poverty back to colonisation in the 15th century to reveal why it's not an accident or simple bad luck that there is a growing underclass around the world. Featuring interviews with a number of economists, sociologists, and historians, the film details how poverty is the clear consequence of free-market economic policy which has allowed powerful nations to exploit poorer ones for their assets, turning the money back to the hands of the concentrated few. This also follows on to how wealthy nations--especially the United States--thereby exert massive debts, seize a much disproportionate exploit of the natural world, and how this deep imbalance has dire consequences on the environment and on people...

Your retirement plan, if you're even lucky enough to have one, is a gamble. Fees, self-dealing, kickbacks, deregulation and/or no regulation at all brings great profits to the financial system, while imperiling the future of individuals who provide 100% of the funds, take 100% of the risks, but only get 30% of the returns. Even the privileged Baby Boomer generation now faces uncertainties, to say nothing of those who come after and face an even more staggering wealth inequality. The paternalistic "American dream" of the 1950s has long been over. Now, thanks to decades of neoliberalism, with a financial system geared towards short term profits and externalising risks and costs, the retirement fund industry is a ten trillion dollar industry, protected by obfuscation and complexity. The Retirement Gamble offers a window into this racket, raising just some of the troubling questions about how this supposed system claims to "work for everyone" when it does nothing of the sort, by design.

The Chicago Sessions explores the ethical implications of the financial crisis during three sessions with a group of law and philosophy students. The grounds of the University of Chicago provide a compelling arena, since it is here that both economist Milton Friedman—staunch promoter of free market capitalism—and Barack Obama, lectured. Examples of crisis related issues discussed during the sessions are: mortgage lending practices, foreclosures, bail outs and CEO pay. The students will test their ideas both on eminent professors and on field experts. The discussion is fueled and illustrated by case stories that the students themselves provide. The cases show how the financial crisis really affects the people of Chicago and in one example shows the consequences of the foreclosures in a neighborhood not far from the university and Barack Obama's home.

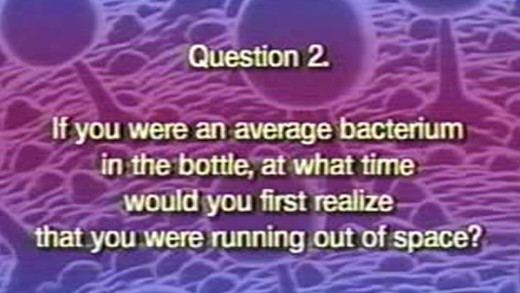

The film is a video essay by Professor Albert Bartlett essentially serving as an introduction to the concept of steady growth and doubling time, by taking us through the impacts and consequences of exponential growth on a finite planet. By making good observations of this impossible growth as applied to fossil-fuel consumption, population and the endless growth of which the global economy requires, this presentation gives us the basic tools to fundamentally understand that we've got a real problem on our hands.

"Quants" are the mathematicians, software developers and computer programmers at the centre of the global economy. These are the people who designed the "complex financial products" that caused the financial crisis of 2008. Here they speak openly about their game of huge profits, and how the global economy has become increasingly dependent on mathematical models that quantify commodified human behaviours to the point of insanity. But things don't stop there. Through the convergence of economy and technology, the Quants have now brought this model into the world of the machines, where trades are done at the speed of light, far from the realm of human experience. The machines are in charge. Some Quants are even now worried. What are the risks of this complex machine? Will the Quants be able to keep control of this financial system, or have they created a monster?

Mongolia is the next target for the world's biggest mining corporations for copper. The Oyu Tolgoi mine currently under construction in the South Gobi Desert is a combined open-pit and underground mine due to start extraction in the next few months of 2012. But the problems don't end there. The Oyu Tolgoi deal between the Mongolian government and the massive Australian mining company Rio Tinto is truly indicative—Mongolia gets just 34 percent, while Rio Tinto is exempt from a profits tax and receives open access to scarce desert aquifers and the provisioning of water to people living close to land that the mining company now claims to own. The Big Dig documents how this avaricious mining-driven culture comes at the expense of the natural world and the way of life of local communities.

Housing is fundamental human right. But in cities all around the world, housing affordability is decreasing at record pace. The local working and middle classes have become unable to afford housing in major cities: London, New York, Berlin, Hong Kong, Toronto, Tokyo, Valparaiso, Sydney, Melbourne, Caracas, Barcelona, Paris, Amsterdam, Stockholm... the list seems endless. People are being pushed out of their very own homes--because living in them has rapidly become unaffordable. Told through the eyes of Leilani Farha, a United Nations special rapporteur on housing, Push touches on the foundations of the crisis, as we follow the rise of abstract finance and the pervasive influence of neoliberalism that conjures a perfect storm: the global financial crisis of 2008--where houses packaged as "complex financial instruments" were the core of the crisis. Then, once the financial industry was bailed out by the public to the tune of trillions of dollars, financiers bought up millions of houses around the globe for cents on the dollar, and their power and influence has only increased in the subsequent decades. Farha travels all around the world, speaking to people that now spend 90% of their income on rent, after wages have stayed stagnant since 1970s, and how large corporations swallow up entire communities, guided by the same politik. She says we still need to confront those old ideas--the financialisation of the housing 'market.' "There's a huge difference between housing as a commodity and gold as a commodity." These systems don't consider the people they extract from.

Why did appointed officials of the Australian Reserve Bank and its employees break sanctions in Iraq and cosy up to Saddam Hussein through a frontman during the late 1990s, early 2000s and beyond? Why did a former Deputy Governor and other directors hand-picked by the Reserve Bank to safeguard its subsidiary companies from corruption, end up--over a decade--overseeing some of the most corrupt business practices possible? How did they allow millions of dollars to be wired to third parties in foreign countries--including a known arms dealer--in order to win banknote contracts knowingly using bribery and supporting corruption?

The Mayfair Set is a four part series that studies how capitalists overtly and surreptitiously came to prolifically shape governments during the 1980s, epitomised by the Thatcher government in Britain at the time. But the corporate influence of political power doesn't simply arrive, it rather culminates after decades of engineering rooted in the economic collapse from the aftermath of the Second World War. This series focuses on the unreported and almost unseen approach that capitalists have taken since the 1940s to gradually take control of the political systems of not only the United States and Britain, but elsewhere around the world—exemplified by the boom of globalisation.

Freakonomics is a segmented adaptation of the book by the same name, by Steven Levitt and Stephen Dubner about incentives-based thinking. The film presents segments to examine the theories of human behaviour and data mining presented in the book through case studies. Subjects include: the influence a person's name has on their personal and social development; corruption in an honor-bound sport such as sumo wrestling; what alleged factors lead to a statistical reduction in crime rates in the United States during the 1990s; and a school experiment to see if cash payments could incentivise students to get good grades. Through these examples and others, the film exposes the problems with data-driven economic incentive models, and the society obsessed with quantitative measuring and data, rather than a focus on quality of outcomes or even what the outcomes are.

Corporations On Trial is a five-part series following just some of the many lawsuits being brought against multinational corporations for war crimes, conspiracy, corruption, assassinations, environmental devastation and payments to terrorists. Such serious charges have forced some of the world's largest companies to hire high-profile defence lawyers to protect public relations in cases often brought by plaintiffs who are barely literate. These five films reveal a growing anxiety about the power and influence of big business, as many multinational corporations have annual revenues greater than some countries' national budgets and indeed increasingly hold governments to ransom by their economic power. Around the world, ordinary people are fighting back and asking how many more times their interests should be sacrificed for corporate greed and shareholder profit...

Shifty is a series of films that traverse the past 40 years in Britain, showing how the shift of political power to finance and hyper-individualism came together in powerful ways, to undermine one of the fundamental structures of mass democracy--the shared idea of what is real. As that fell apart, with it went the language and the ideas that people had turned to for the last 150 years to make sense of the world they lived in. As a result, life in Britain and the current and former colonies of its empire, has become strange--a hazy dream-like flux, where distrust in politicians keeps growing, and the political class seems to have lost control. Through archive footage, news reels, and on-screen-text in video essay format, Shifty documents the shapes of how this happened, using the vast ranges of footage to evoke what if felt like to live through an epic transformation during the 1980s.

Brussels, the capital and largest city of Belgium, has a long history of hosting the institutions of the European Union within its European Quarter; while the Union itself claims it has no capital and no plans to declare one--despite the fact that Brussels hosts the official seats of the European Commission, Council of the European Union, and European Council, as well as a seat of the European Parliament. In any event, it is here--in this centre of smoke and mirrors--that exists one of the largest concentrations of lobbyist power in the world. The Brussels Business scratches the surface of this extensive world hidden-from-view by looking at the direct influence of lobbyists and the complete lack of transparency in the decision-making processes. Speaking with lobbyists and activists themselves, The Brussels Business reveals the beginnings of a vast landscape of PR conglomerates, front companies, think-tanks and their closely-interlinking networks of power and ties to political and economic elites. The questions then become: Who actually runs the European Union? How? And why?

War By Other Means examines the policy of western banks making loans to so-called 'third world' countries, which are then unable to meet the crippling interest charges—debt used as a weapon. The film primarily analyses 'Structural Adjustment Programs,' which are proclaimed to enable countries to compete in the 'global economy,' but have the opposite effect of lowering wages which in turn further transfers the wealth from the poor to the rich.

In post-industrial United States, the Chinese company Fuyao opens a car-glass factory in an abandoned General Motors plant, hiring thousands of blue-collar American and Chinese workers. Through an an observational format, American Factory presents the two distinct cultures, comparing and contrasting each other, as well as weaving subtle commentary revealed from the workers' themselves about the nature of manufacturing work; their differing cultural and generational attitudes on labour rights and unionising; as well as observing upper management methods and corporate politics. The film is a collage of self-revealing messages about the cultures of high-tech China and post-industrial United States, shown through the lens of capitalism and the changing status of each country in the global economy.

Exploring the collusion between the richest people in the United States and the figureheads of political power in government, this film focuses on Park Avenue in New York which is currently the home to the highest concentration of billionaires in the United States. Across the river in Manhattan, less than five miles away, Park Avenue runs through the South Bronx which is home to the countries' poorest. The disparity of wealth has never been so stark and has accelerated extraordinarily over the last 40 years. As of 2010, 400 people controlled more wealth than the bottom 50 percent of the population—150 million people—as well as seizing political power. Park Avenue travels through this to illustrate why the concept of so-called "upward mobility" is a myth perpetuated by the rich, and also to unpack the workings of plutocracy and capitalism—the current-day rule by the rich, and the implications of this collusion of power and control.

Drawing on unpublished diaries, memoirs and letters, The Great War documentary series tells the rich and complex story of World War I through the voices of nurses, journalists, aviators and troops who came to be known as “doughboys.” The series explores the experiences of African-American and Latino soldiers, suffragists, Native American “code talkers” and others whose participation in the war has been largely forgotten. The series explores how a brilliant PR man bolstered support for the war in a country hesitant to put lives on the line for a foreign conflict, and how the ardent patriotism and determination to support America’s crusade led to one of the most oppressive crackdowns on civil liberties at home in US history.