Shifty

Shifty is a series of films that traverse the past 40 years in Britain, showing how the shift of political power to finance and hyper-individualism came together in powerful ways, to undermine one of the fundamental structures of mass democracy--the shared idea of what is real. As that fell apart, with it went the language and the ideas that people had turned to for the last 150 years to make sense of the world they lived in. As a result, life in Britain and the current and former colonies of its empire, has become strange--a hazy dream-like flux, where distrust in politicians keeps growing, and the political class seems to have lost control. Through archive footage, news reels, and on-screen-text in video essay format, Shifty documents the shapes of how this happened, using the vast ranges of footage to evoke what if felt like to live through an epic transformation during the 1980s.

Skandal!

Skandal! Bringing Down Wirecard is a thriller documentary of one of the largest world-wide financial crimes. It follows journalist Dan McCrum, who reveals the inside story of a 6-year investigation into the German corporation Wirecard and the dirty tricks that were deployed against him and the Financial Times, as they battle to expose a multi-billion euro fraud at the centre of one of Germany's most successful online payment corporations of the time. The film traverses the colourful characters of the scam, such as the mafia, porn barons, gambling outfits, Libyan and Russian intelligence agencies, corporate spies, private investigators, hired thugs and surveillance operatives, demanding answers of the chief executive officer, Markus Braun, awaiting trial in Munich, and its mysterious chief operating officer, Jan Marsalek, who vanishes.

Far from ending with the abolition of slavery, the trade in human beings is thriving more than ever before. Today, 27 million men, women and children are held, sold and trafficked as slaves throughout the world. From the sex slaves of Eastern Europe to China's prison labour slaves; from Brazil's hellish charcoal slave camps to entire families enslaved in Pakistan's brick kilns, this series exposes the people behind modern slavery and the companies who profit from it.

Filmed in Thailand and the Philippines in July 2007, Squeezed tells the story of how free trade agreements and globalisation are changing the lives of millions of people living in the Asia-Pacific region with APEC. Featuring interviews with farmers, workers and slum-dwellers, the film travels across the landscapes of Asia, from the lush rice paddies of Thailand to squatter settlements perched on a rubbish dump in urban Manila. Documenting these contrasts and contradictions, Squeezed accounts the impact of globalisation...

Featuring George Bush's famous "go-shopping-speech" calling for a war against terrorism that deters the nation from the fear of consumption; Castro responding with hymns to the anti-consumerist, advertising-free island of Cuba; Bill Gates and Steve Ballmer preaching that the computer will give us peace on earth, and "bring people together rather than isolate them"; while Adbuster Kalle Lasn warns that advertising pollutes us mentally, that over-consumption is unsustainable, that we are running out of oil and this will cause a global economic collapse...

For millions of people, the global economic collapse has generated curiosity about how money systems actually work, as opposed to how they're portrayed, especially when so many financial pundits seem to be baffled. In The Ascent of Money, economist Niall Ferguson works through some history that created today's money system, visiting the locations where key events took place and poring over actual ledgers and documents, such as the first publicly traded share of a company. Viewed with a critical eye, this series aims to show how the history of money is indeed at the core of civilisation, with economic strength determining political dominance, wars fought to create wealth and individual financial barons determining the fates of millions.

The Big Sellout reveals the reality of privatisation and globalisation by examining the corporate takeover of basic public services throughout the world, such as water supply, electricity, public transportation, and public health care. In South America, Asia, Africa, but also in Europe and the United States, filmmaker Florian Opitz talks to the architects of the new economic world order, as well as to ordinary people who have to deal with the real direct effects. The result is a tapestry of narratives the world over that show where the dogma of privatisation cames from, who profits from it, what societies lose, and why resistance is so important.

Did you know that the legal system recognises a corporation as a person? What kind of 'person' is it then? What would happen if it sat down with a psychologist to discuss its behaviour and attitude towards society and the environment? Explored through specific examples, this film shows how and why the modern-day corporation has rapaciously pressed itself into the dominant institution of our time, posing big questions about what must be done if we want a equitable and sustainable world. What must we do when corporations are psychopaths?

The Crisis of Civilization draws on archive footage and essentially monologue by author Nafeez Mosaddeq Ahmed to detail how global problems like environmental collapse, financial crisis, peak energy, terrorism and food shortages are all symptoms of a single, failed global system...

While corporations and governments continue to disseminate globalisation and the rapacious drive for consolidation of corporate power, people around the world are pushing back to reinstate local communities. Groups are coming together to rebuild human scale, local and ecological economies based on a new paradigm of localisation and sustainability. The Economics Of Happiness documents these shifts and shows how these communities have reclaimed their autonomy...

The End of Poverty? traces the growth of global poverty back to colonisation in the 15th century to reveal why it's not an accident or simple bad luck that there is a growing underclass around the world. Featuring interviews with a number of economists, sociologists, and historians, the film details how poverty is the clear consequence of free-market economic policy which has allowed powerful nations to exploit poorer ones for their assets, turning the money back to the hands of the concentrated few. This also follows on to how wealthy nations--especially the United States--thereby exert massive debts, seize a much disproportionate exploit of the natural world, and how this deep imbalance has dire consequences on the environment and on people...

Robert Beckford visits Ghana to investigate the hidden costs of rice, chocolate and gold and why, 50 years after independence, a country so rich in 'natural resources' is one of the poorest in the world. He discovers child labourers farming cocoa instead of attending school and asks if the activities of multinationals, the World Bank and International Monetary Fund have actually made the country’s problems worse...

For more than two years the Eurozone has teetered on the edge of an economic precipice. But how exactly did it get into the current financial mess? Talking to historians, economists and politicians, The Great Euro Crash takes a long view of the euro--from Churchill's vision of a United States of Europe; to the bail-outs of Greece, Portugal and Ireland. Meeting a property developer in Ireland, a taxi driver in Rome and a German manufacturing worker; the film exposes the high cost being paid by European workers today for the dream of European Union—how the entire system has so far come to a complete banking meltdown. The crisis could yet claim Britain, with its vast financial sector, dragged down by the collapse of the euro. And the cost of reviving the complex economy is so high, triggering a return to the economic mayhem of the 1930s.

The Mayfair Set is a four part series that studies how capitalists overtly and surreptitiously came to prolifically shape governments during the 1980s, epitomised by the Thatcher government in Britain at the time. But the corporate influence of political power doesn't simply arrive, it rather culminates after decades of engineering rooted in the economic collapse from the aftermath of the Second World War. This series focuses on the unreported and almost unseen approach that capitalists have taken since the 1940s to gradually take control of the political systems of not only the United States and Britain, but elsewhere around the world—exemplified by the boom of globalisation.

The myths of globalisation have been incorporated into much of our everyday language. "Thinking globally" and "the global economy" are part of a jargon that assumes we are all part of one big global village, where national borders and national identities no longer matter. But what is globalisation? And where is this global village? In some respects you are already living in it. The clothes in your local store were probably stitched together in the factories of Asia. Much of the food in your local supermarket will have been grown in Africa...

Based on the book of the same title by Juliet Schor, The Overspent American scrutinises the form of consumerism ever-pervasive in this current era that is driven by upscale spending and debt; shaped and reinforced by a media system driven by commercial interests. We're encouraged from all angles to spend money we don't have, working longer hours than ever before. Illustrated with hundreds of examples, The Overspent American draws attention to both the financial and social costs of this giant consumption machine, where the frivolous and relentless search for "happiness" and identity is espoused by advertising.

The Power of the Fed investigates how the United States central bank's actions have played out over the years on Wall Street versus Main Street, since the last financial crash of 2008. The film traces how the experiment the Fed began in 2008 has been dramatically ratcheting up, peaking with the COVID-19 crisis in 2020. But, of course, rather than help correct from the huge corruption and financial abstractions that caused the 2008 crash, the fed has doubled down on its policies of "quantitative easing" which have gone on to help widen the greatest inequality of wealth in history, pushing financial products even further removed from the economy, driving inflation, automation, and worsening the impending cycles of boom and bust. The rise of speculative cryptocurrencies and non-fungible tokens (NFTs) has only fueled the mania, as economic volatility increases.

By comparing the confluence of ideas about modifying behaviour using shock therapy and other forms of sensory deprivation (which culminated in the top-secret CIA project called MKULTRA during the 1950s) alongside the metaphor of similar shock treatment modifying national economics using the teachings of Milton Friedman and the Chicago School of economics, The Shock Doctrine presents the workings of global capitalism in this framework of how the United States, along with other western countries, has exploited natural and human-engineered disasters across the globe to push through reforms and set-up other mechanisms that suit those in power and 'shock' other countries into a certain wanted behaviour. Chronologically, some historical examples are the using of Pinochet's Chile, Argentina and its junta, Yeltsin's Russia, and the invasion of Iraq. A trumped-up villain always provides distraction or rationalisation for the intervention of the United States—for example, the threat of Marxism, the Falklands, nuclear weapons, or terrorists—and further, is used by those in power as more justification for the great shift of money and power from the many into the hands of the few(er).

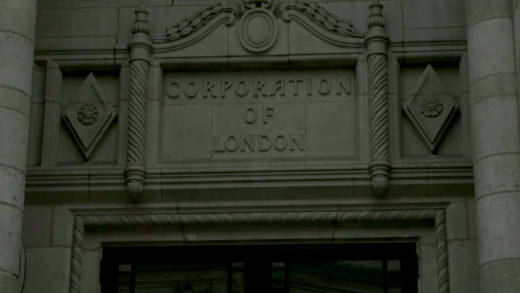

The Spider's Web: Britain's Second Empire shows how Britain transformed from a colonial power into a global financial power. At the demise of empire, the City of London's financial interests created a web of offshore secrecy jurisdictions that captured wealth from across the globe and hid it behind obscure financial structures, and webs of offshore islands. Today, up to half of global offshore wealth may be hidden in British offshore jurisdictions, and these are now the largest players in the world of international finance. Based in part on the book Treasure Islands by expert Nicholas Shaxson, and through contributions from former-insiders, academics, and campaigners for justice, The Spider's Web reveals how, in the world of international finance, corruption and secrecy have prevailed over regulation and transparency, and how the United Kingdom is a pioneer of the modern corrupt global economy.

The Tax Free Tour travels the globe to expose the workings of offshore tax havens and the elite banking systems of the world's billionaires which operate in extreme secrecy. Using examples from multi-national corporations such as Apple Computer and Starbucks, the film traces sizeable capital streams that travel the world literally in milliseconds--all to avoid local laws and paying tax. Such routes go by resounding names like 'Cayman Special', 'Double Irish', and 'Dutch Sandwich'. The Tax Free Tour is a sobering look at how the world's rich live in an entirely different world than the rest of us...

The Wall Street Code explores the once-secret lucrative world of prolific algorithmic trading by profiling an inside programmer who, in 2012, dared to stand up against Wall Street and its extreme culture of secrecy, to blow the whistle on insights into the way the modern global money market works. His name is Haim Bodek—aka 'The Algo Arms Dealer'—and having worked for Goldman Sachs, his revelations speak to the new kind of wealth made only possible by vast mathematical formulas, computer technologies and clever circumventions of laws and loophole exploits. Vast server farms and algorithms working beyond the timescale of human comprehension, have largely taken over human trading on the global financial markets for decades. What are the implications of that? The algorithms seem to have a life of their own. Snippets of code secretly lie waiting for the moment that your pension fund gets on the market; trades done in nanoseconds on tiny fluctuations in stock prices. And the only ones who understand this system are its architects—the algorithm developers. The Wall Street Code provides just a small insight into this new world of high-frequency trading, amongst other things...

For more than three decades, transnational corporations have been busy buying up what used to be thought of and known as unbuyable--forests, oceans, public broadcast airwaves, important intellectual and cultural works. Before their commodification, these commons were recognised as things in common to all people, for the benefit of all people. In This Land is Our Land, author David Bollier confronts the free-market extremism of our age to show how commercial interests have been undermining the public interest for years, and how it's become so normalised that we don't even notice it anymore. By revealing the commons within the tradition of community engagement and the free exchange of ideas and information, This Land is Our Land shows how a bold new international movement is trying to reclaim the commons for the public good by modelling practical alternatives to the restrictive monopoly powers of corporate elites.

Recorded by over 100 media activists, this film tells the story of the enormous street protests in Seattle, Washington in November 1999, against the World Trade Organisation summit. Vowing to oppose--among other faults--the WTO's power to arbitrarily overrule nations' environmental, social and labour policies in favour of unbridled corporate greed, thousands of people from all around the United States came out in force to stop the summit. Against them was a brutal police force and a hostile media. This Is What Democracy Looks Like documents the struggle, as well as providing a narrative to the history of success and failure of modern political resistance movements.

War By Other Means examines the policy of western banks making loans to so-called 'third world' countries, which are then unable to meet the crippling interest charges—debt used as a weapon. The film primarily analyses 'Structural Adjustment Programs,' which are proclaimed to enable countries to compete in the 'global economy,' but have the opposite effect of lowering wages which in turn further transfers the wealth from the poor to the rich.