Over six desperate days in October 1929, the New York Stock Exchange crashed leading to the collapse of three thousand banks, taking people's savings with them. In a matter of days, the United States economy was obliterated. The crash was followed by a devastating worldwide depression that lasted until the Second World War. Finances did not regain their pre-crash values until 1954. This film recounts the story of a financial disaster that we hoped could never happen again, revealing the familiar tune of cheap credit, consumerism, greed, corruption and cronyism in the current-day financial crisis...

25 Million Pounds details the collapse of Barings Bank in the mid 1990s primarily by a broker called Nick Leeson, who lost £827 million ($1.3 billion) by speculating on futures contracts. The film contextualises the downfall as the history of Barings Bank was one of the oldest and most prestigious merchant banks in Britain, run by the same family for decades with extensive ties to Britain's elites. But in the late 19th century Barings almost went bankrupt after investing heavily in South American bonds, including backing the construction of a sewer system in Buenos Aires. The bank was saved by The Bank of England, but Edward Baring, the head of the bank, was financially ruined and never recovered. This film explores the culture of Barings and of the financial markets during the 1990s, and how Nick Leeson was able to cause another huge loss of money to the bank, this time bankrupting the company. He did this by claiming fictitious profits on the Singapore International Monetary Exchange and using money requested from London as margin payments on fictitious trades to finance his loss-making positions. It's also the profile of a stereotypical corporate psychopath, as Leeson himself explains how he was able to manipulate those around him to achieve his ends and rationalise his actions.

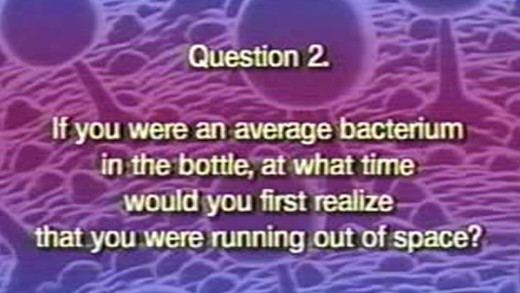

The film is a video essay by Professor Albert Bartlett essentially serving as an introduction to the concept of steady growth and doubling time, by taking us through the impacts and consequences of exponential growth on a finite planet. By making good observations of this impossible growth as applied to fossil-fuel consumption, population and the endless growth of which the global economy requires, this presentation gives us the basic tools to fundamentally understand that we've got a real problem on our hands.

In recent years, nature conservation has become a booming business where huge sums of money change hands, and endangered species become exotic financial products. Banking Nature, delves into this hidden world of so-called environmental banking, where huge corporations such as Merrill Lynch and JP Morgan Chase buy up the land and habitat of endangered species, and then sell them in the form of shares. Companies that inevitably harm the environment are then obliged to buy credits to offset the damage that they have caused. In Uganda, we meet men who measure trees to determine how much carbon they store and then a banker from the German firm that sells the resulting carbon credits. In Brazil, the steel giant Vale destroys the rainforest, replaces it with a monocrop tree plantation, and reaps the benefits of environmental credits as if the rainforest was still standing. Banking Nature posits that we disallow the same corporate criminals responsible for the global financial crisis from turning what's left of the natural world into their final corrupt commodities market.

In September 2008 when the American economy was on the verge of melting down, the then-Secretary of the Treasury Henry Paulson, his former protégé John Thain (CEO of Merrill Lynch), and Ken Lewis (CEO, President, and Chairman of the Bank of America) secretly cut a deal to merge Bank of America and Merrill Lynch -- in the midst of stock collapse; a rocky merger; the worst fourth-quarter losses in at least 17 years; a stockholder revolt and an urgent need to raise more capital despite a $45 billion "bail-out" from the federal government...

The 2008 'financial crisis' was a systemic fraud in which wealthy finance capitalists stole trillions of public dollars all over the world. No one was jailed for this massive crime, the largest theft of public money in history. Instead, the rich forced working people across the globe to pay for their 'crisis' through punitive austerity programs that gutted public services and repealed workers' rights. Capitalism Is The Crisis shows and explains this fundamental functioning of the global economy, while visiting protests from around the world against it, revealing revolutionary paths for the future. Special attention is devoted to the current situation in Greece, the 2010 G20 Summit protest in Toronto Canada, and the remarkable surge of solidarity in Madison, Wisconsin.

Catastroïka follows the global trend of privatisations in the past two decades, extrapolating the forthcoming results of the current sell-off in Greece, which has been demanded in order to face the country's enormous debts. Turning to the examples of London, Paris, Berlin, Moscow and Rome, Catastroïka predicts what will happen, if the model imposed in these areas is imported in a country under international financial tutelage...

Confessions of an Economic Hit Man is a presentation by John Perkins, based on the book by the same name published by him in 2004. Perkins describes the role: "Economic hit men are highly-paid professionals who cheat countries around the globe out of trillions of dollars. They funnel money from the World Bank, the US Agency for International Development (USAID), and other foreign "aid" organisations into the coffers of huge corporations and the pockets of a few wealthy families who control the planet's natural resources. Their tools included fraudulent financial reports, rigged elections, pay-offs, extortion, sex, and murder. They play a game as old as empire, but one that has taken on new and terrifying dimensions during this time of globalisation."

Cover Up

Why did appointed officials of the Australian Reserve Bank and its employees break sanctions in Iraq and cosy up to Saddam Hussein through a frontman during the late 1990s, early 2000s and beyond? Why did a former Deputy Governor and other directors hand-picked by the Reserve Bank to safeguard its subsidiary companies from corruption, end up--over a decade--overseeing some of the most corrupt business practices possible? How did they allow millions of dollars to be wired to third parties in foreign countries--including a known arms dealer--in order to win banknote contracts knowingly using bribery and supporting corruption?

Dirty Money

In the late 1990s, the Reserve Bank of Australia thought it was on a winner. The bank had developed the technology to create polymer bank notes that it claimed rivalled paper money. So the Reserve Bank decided to set up a subsidiary company called Securency to sell the technology to the world. It had just one problem though—getting legitimate access to other central bank officials to pitch the idea. So instead, Securency decided to employ a shadow network of local "fixer agents" to make "connections" with relevant officials, lavishing them with prostitutes, cash, and bribing them into deals. Dirty Money is the story of this institutional corruption at the highest level of finance in Australia.

Inside Job provides a comprehensive analysis of the global financial crisis of 2008, which at a cost over $20 trillion, caused millions of people to lose their jobs and homes in the worst recession since the Great Depression, and nearly resulted in a global financial collapse. Through interviews with key financial insiders, politicians, journalists, and academics, Inside Job traces the rise of a rogue industry which has corrupted government and academia...

Let's Make Money investigates the development of the world-wide financial system, showing that elitists economically exploit the rest of society, especially in the developing world, but also in western nations. Using the savings of a typical depositor as a case study, the film moves around the global system, showing exploitation at many levels. There are several interviews with investment managers, politicians, economists as well as homeless people and workers who give their take on the system and its impacts...

There are plenty of anarchists in the world. Many have committed robbery or smuggling for their cause. Fewer have discussed strategies with Che Guevara or saved the skin of Eldridge Cleaver, the leader of the Black Panthers. There is only one who has done all that, and also brought to its knees the most powerful bank in the world by forging travellers cheques, without missing a single day of work bricklaying. He is Lucio Urtubia from a tiny village in Navarra in North of Spain. Lucio, 75, now lives in Paris, still doing valued political work. Lucio has been protagonist and witness to many of the historic events of the second half of the 20th century. His family was persecuted by Franco's regime; he was on the streets of Paris for the phenomenon of May of 1968; he actively supported Castro's revolution; and helped thousands of exiled people by providing false documents to them. But without a doubt, his greatest triumph came in the second half of the 1970s where he swindled 25 million dollars from the First National Bank--or Citibank--to later invest the money in causes he believed in.

Money is a new form of slavery and is only distinguishable from the old slavery simply by the fact that it is impersonal--that there is no human relation between master and slave. Debt in government, corporate and household has reached astronomical proportions. Where does all this money come from? How could there be that much money to lend? The answer is that there isn’t...

Nearly 100 years after its creation, the power of the United States Federal Reserve has never been greater. Governments and financial systems around the world pay close attention to the Fed Chairman's every word, philosophies and ideologies. Yet the average person knows very little about the most powerful and least understood financial institution. Money For Nothing takes viewers inside the Fed and reveals the impact of Fed policies past, present, and future.

With the recent global financial crisis, governments across the world promised decisive action -- the biggest financial stimulus packages in history, along with gargantuan bail-outs of corporations and floods of money into private banks and investment firms. But what crazed logic is this: propping up bad debt with…more bad debt? Overdose reviews the happenings of the bail-outs over these years, showing how dangerous the situation continues as a burst bubble is re-inflated globally. What happens next?

Push

Housing is fundamental human right. But in cities all around the world, housing affordability is decreasing at record pace. The local working and middle classes have become unable to afford housing in major cities: London, New York, Berlin, Hong Kong, Toronto, Tokyo, Valparaiso, Sydney, Melbourne, Caracas, Barcelona, Paris, Amsterdam, Stockholm... the list seems endless. People are being pushed out of their very own homes--because living in them has rapidly become unaffordable. Told through the eyes of Leilani Farha, a United Nations special rapporteur on housing, Push touches on the foundations of the crisis, as we follow the rise of abstract finance and the pervasive influence of neoliberalism that conjures a perfect storm: the global financial crisis of 2008--where houses packaged as "complex financial instruments" were the core of the crisis. Then, once the financial industry was bailed out by the public to the tune of trillions of dollars, financiers bought up millions of houses around the globe for cents on the dollar, and their power and influence has only increased in the subsequent decades. Farha travels all around the world, speaking to people that now spend 90% of their income on rent, after wages have stayed stagnant since 1970s, and how large corporations swallow up entire communities, guided by the same politik. She says we still need to confront those old ideas--the financialisation of the housing 'market.' "There's a huge difference between housing as a commodity and gold as a commodity." These systems don't consider the people they extract from.

"Quants" are the mathematicians, software developers and computer programmers at the centre of the global economy. These are the people who designed the "complex financial products" that caused the financial crisis of 2008. Here they speak openly about their game of huge profits, and how the global economy has become increasingly dependent on mathematical models that quantify commodified human behaviours to the point of insanity. But things don't stop there. Through the convergence of economy and technology, the Quants have now brought this model into the world of the machines, where trades are done at the speed of light, far from the realm of human experience. The machines are in charge. Some Quants are even now worried. What are the risks of this complex machine? Will the Quants be able to keep control of this financial system, or have they created a monster?

In Requiem for the American Dream, renowned intellectual figure Noam Chomsky deliberates on the defining characteristics of our time—the colossal concentration of wealth and power in the hands of the few and fewer, with the rise of a rapacious individualism and complete collapse of class consciousness. Chomsky does this by discussing some of the key principles that have brought this culture to the pinnacle of historically unprecedented inequality by tracing a half century of policies designed to favour the most wealthy at the expense of the majority, while also looking back on his own life of activism and political participation. The film serves to provide insights into how we got here, and culminates as a reminder that these problems are not inevitable. Once we remember those who came before and those who will come after, we see that we can, and should, fight back.

Since the late 1980s, BBC news crews have filmed all across the Soviet Union and Russia, but only a tiny portion of their footage was ever used for news reports. The rest was left unseen on tapes in Moscow. Filmmaker Adam Curtis obtains these tapes and uses them to chronicle the collapse of the Soviet Union, the rise of capitalist Russia and its oligarchs, and the effects of this on Russian people of all levels of society, leading to the rise to power of Vladimir Putin, and today's invasions of Ukraine. The films take you from inside the Kremlin, to the frozen mining cities in the Arctic circle, to tiny villages of the vast steppes of Russia, and the strange wars fought in the mountains and forests of the Caucasus.

Shifty

Shifty is a series of films that traverse the past 40 years in Britain, showing how the shift of political power to finance and hyper-individualism came together in powerful ways, to undermine one of the fundamental structures of mass democracy--the shared idea of what is real. As that fell apart, with it went the language and the ideas that people had turned to for the last 150 years to make sense of the world they lived in. As a result, life in Britain and the current and former colonies of its empire, has become strange--a hazy dream-like flux, where distrust in politicians keeps growing, and the political class seems to have lost control. Through archive footage, news reels, and on-screen-text in video essay format, Shifty documents the shapes of how this happened, using the vast ranges of footage to evoke what if felt like to live through an epic transformation during the 1980s.

Skandal!

Skandal! Bringing Down Wirecard is a thriller documentary of one of the largest world-wide financial crimes. It follows journalist Dan McCrum, who reveals the inside story of a 6-year investigation into the German corporation Wirecard and the dirty tricks that were deployed against him and the Financial Times, as they battle to expose a multi-billion euro fraud at the centre of one of Germany's most successful online payment corporations of the time. The film traverses the colourful characters of the scam, such as the mafia, porn barons, gambling outfits, Libyan and Russian intelligence agencies, corporate spies, private investigators, hired thugs and surveillance operatives, demanding answers of the chief executive officer, Markus Braun, awaiting trial in Munich, and its mysterious chief operating officer, Jan Marsalek, who vanishes.

For millions of people, the global economic collapse has generated curiosity about how money systems actually work, as opposed to how they're portrayed, especially when so many financial pundits seem to be baffled. In The Ascent of Money, economist Niall Ferguson works through some history that created today's money system, visiting the locations where key events took place and poring over actual ledgers and documents, such as the first publicly traded share of a company. Viewed with a critical eye, this series aims to show how the history of money is indeed at the core of civilisation, with economic strength determining political dominance, wars fought to create wealth and individual financial barons determining the fates of millions.

The Wall Street bombing occurred on September 16, 1920, when a horse-drawn wagon filled with dynamite exploded in front of J.P. Morgan & Co., killing 38 people and injuring hundreds. The attack was never solved, but it is believed to have been carried out by anarchists as a form of political violence against capitalism. The bombing helped launch the career of a young J. Edgar Hoover and sparked a bitter national debate about how far the government should go to protect the nation from acts of political violence.

The Chicago Sessions explores the ethical implications of the financial crisis during three sessions with a group of law and philosophy students. The grounds of the University of Chicago provide a compelling arena, since it is here that both economist Milton Friedman—staunch promoter of free market capitalism—and Barack Obama, lectured. Examples of crisis related issues discussed during the sessions are: mortgage lending practices, foreclosures, bail outs and CEO pay. The students will test their ideas both on eminent professors and on field experts. The discussion is fueled and illustrated by case stories that the students themselves provide. The cases show how the financial crisis really affects the people of Chicago and in one example shows the consequences of the foreclosures in a neighborhood not far from the university and Barack Obama's home.

For more than two years the Eurozone has teetered on the edge of an economic precipice. But how exactly did it get into the current financial mess? Talking to historians, economists and politicians, The Great Euro Crash takes a long view of the euro--from Churchill's vision of a United States of Europe; to the bail-outs of Greece, Portugal and Ireland. Meeting a property developer in Ireland, a taxi driver in Rome and a German manufacturing worker; the film exposes the high cost being paid by European workers today for the dream of European Union—how the entire system has so far come to a complete banking meltdown. The crisis could yet claim Britain, with its vast financial sector, dragged down by the collapse of the euro. And the cost of reviving the complex economy is so high, triggering a return to the economic mayhem of the 1930s.

The Power of the Fed investigates how the United States central bank's actions have played out over the years on Wall Street versus Main Street, since the last financial crash of 2008. The film traces how the experiment the Fed began in 2008 has been dramatically ratcheting up, peaking with the COVID-19 crisis in 2020. But, of course, rather than help correct from the huge corruption and financial abstractions that caused the 2008 crash, the fed has doubled down on its policies of "quantitative easing" which have gone on to help widen the greatest inequality of wealth in history, pushing financial products even further removed from the economy, driving inflation, automation, and worsening the impending cycles of boom and bust. The rise of speculative cryptocurrencies and non-fungible tokens (NFTs) has only fueled the mania, as economic volatility increases.

The Secret History of the Credit Card uncovers the deceptive techniques and tactics used by banks and financial corporations to get citizens to take on ever more debt, while earning record profits. Penalty fees, defaulting, changing contracts, increasing rates retrospectively---these are some of the ways credit card companies gouge their users, and increase influence. The film shows how such profitability of credit cards began in the 1980s, when the banking industry successfully eliminated the limit on the interest rate a lender can charge a borrower. This deregulation, coupled with real-time tracking of personal financial information, facilitated the widening availability of credit cards. Despite a growing number of consumer complaints, the ability of state and local governments to investigate the credit card companies has virtually been eliminated, due to companies incessant lobbying and litigation that has created a jurisdictional "turf battle."