Shifty

Shifty is a series of films that traverse the past 40 years in Britain, showing how the shift of political power to finance and hyper-individualism came together in powerful ways, to undermine one of the fundamental structures of mass democracy--the shared idea of what is real. As that fell apart, with it went the language and the ideas that people had turned to for the last 150 years to make sense of the world they lived in. As a result, life in Britain and the current and former colonies of its empire, has become strange--a hazy dream-like flux, where distrust in politicians keeps growing, and the political class seems to have lost control. Through archive footage, news reels, and on-screen-text in video essay format, Shifty documents the shapes of how this happened, using the vast ranges of footage to evoke what if felt like to live through an epic transformation during the 1980s.

The Power of the Fed investigates how the United States central bank's actions have played out over the years on Wall Street versus Main Street, since the last financial crash of 2008. The film traces how the experiment the Fed began in 2008 has been dramatically ratcheting up, peaking with the COVID-19 crisis in 2020. But, of course, rather than help correct from the huge corruption and financial abstractions that caused the 2008 crash, the fed has doubled down on its policies of "quantitative easing" which have gone on to help widen the greatest inequality of wealth in history, pushing financial products even further removed from the economy, driving inflation, automation, and worsening the impending cycles of boom and bust. The rise of speculative cryptocurrencies and non-fungible tokens (NFTs) has only fueled the mania, as economic volatility increases.

Push

Housing is fundamental human right. But in cities all around the world, housing affordability is decreasing at record pace. The local working and middle classes have become unable to afford housing in major cities: London, New York, Berlin, Hong Kong, Toronto, Tokyo, Valparaiso, Sydney, Melbourne, Caracas, Barcelona, Paris, Amsterdam, Stockholm... the list seems endless. People are being pushed out of their very own homes--because living in them has rapidly become unaffordable. Told through the eyes of Leilani Farha, a United Nations special rapporteur on housing, Push touches on the foundations of the crisis, as we follow the rise of abstract finance and the pervasive influence of neoliberalism that conjures a perfect storm: the global financial crisis of 2008--where houses packaged as "complex financial instruments" were the core of the crisis. Then, once the financial industry was bailed out by the public to the tune of trillions of dollars, financiers bought up millions of houses around the globe for cents on the dollar, and their power and influence has only increased in the subsequent decades. Farha travels all around the world, speaking to people that now spend 90% of their income on rent, after wages have stayed stagnant since 1970s, and how large corporations swallow up entire communities, guided by the same politik. She says we still need to confront those old ideas--the financialisation of the housing 'market.' "There's a huge difference between housing as a commodity and gold as a commodity." These systems don't consider the people they extract from.

The Spider's Web: Britain's Second Empire shows how Britain transformed from a colonial power into a global financial power. At the demise of empire, the City of London's financial interests created a web of offshore secrecy jurisdictions that captured wealth from across the globe and hid it behind obscure financial structures, and webs of offshore islands. Today, up to half of global offshore wealth may be hidden in British offshore jurisdictions, and these are now the largest players in the world of international finance. Based in part on the book Treasure Islands by expert Nicholas Shaxson, and through contributions from former-insiders, academics, and campaigners for justice, The Spider's Web reveals how, in the world of international finance, corruption and secrecy have prevailed over regulation and transparency, and how the United Kingdom is a pioneer of the modern corrupt global economy.

In Requiem for the American Dream, renowned intellectual figure Noam Chomsky deliberates on the defining characteristics of our time—the colossal concentration of wealth and power in the hands of the few and fewer, with the rise of a rapacious individualism and complete collapse of class consciousness. Chomsky does this by discussing some of the key principles that have brought this culture to the pinnacle of historically unprecedented inequality by tracing a half century of policies designed to favour the most wealthy at the expense of the majority, while also looking back on his own life of activism and political participation. The film serves to provide insights into how we got here, and culminates as a reminder that these problems are not inevitable. Once we remember those who came before and those who will come after, we see that we can, and should, fight back.

In recent years, nature conservation has become a booming business where huge sums of money change hands, and endangered species become exotic financial products. Banking Nature, delves into this hidden world of so-called environmental banking, where huge corporations such as Merrill Lynch and JP Morgan Chase buy up the land and habitat of endangered species, and then sell them in the form of shares. Companies that inevitably harm the environment are then obliged to buy credits to offset the damage that they have caused. In Uganda, we meet men who measure trees to determine how much carbon they store and then a banker from the German firm that sells the resulting carbon credits. In Brazil, the steel giant Vale destroys the rainforest, replaces it with a monocrop tree plantation, and reaps the benefits of environmental credits as if the rainforest was still standing. Banking Nature posits that we disallow the same corporate criminals responsible for the global financial crisis from turning what's left of the natural world into their final corrupt commodities market.

Fascism Inc. examines a series of historical events to compile a view of the past, the present and the future of fascism and its relation to the economic interests of each era—including the current era. The film travels from Mussolini's Italy, to Greece under the Nazi occupation; the civil war and the dictatorship; and from Hitler's Germany to the modern European and Greek fascism. Following on from the foundations of earlier films such as Debtocracy and Catastroika which described the causes of the debt crisis, the impact of the austerity measures, the erosion of democracy and the sell-out of the country’s assets; Fascism Inc. aspires to continue to motivate anti-fascist resistance movements across Europe, and the world.

Nearly 100 years after its creation, the power of the United States Federal Reserve has never been greater. Governments and financial systems around the world pay close attention to the Fed Chairman's every word, philosophies and ideologies. Yet the average person knows very little about the most powerful and least understood financial institution. Money For Nothing takes viewers inside the Fed and reveals the impact of Fed policies past, present, and future.

Six years after the housing bubble burst in the United States in 2008, the worst is yet to come. After a recent landmark settlement, major banks have lifted the freeze on foreclosures, with evictions again in full swing. Public housing budgets have been slashed, while the thin line between home ownership and homelessness grows ever more wide. People are angry about the impunity of the banks and some have found innovative ways of fighting back in an age of austerity. For Sale travels to Chicago and California to see how people at the forefront of the crisis are confronting the collapse of the American dream.

For more than two years the Eurozone has teetered on the edge of an economic precipice. But how exactly did it get into the current financial mess? Talking to historians, economists and politicians, The Great Euro Crash takes a long view of the euro--from Churchill's vision of a United States of Europe; to the bail-outs of Greece, Portugal and Ireland. Meeting a property developer in Ireland, a taxi driver in Rome and a German manufacturing worker; the film exposes the high cost being paid by European workers today for the dream of European Union—how the entire system has so far come to a complete banking meltdown. The crisis could yet claim Britain, with its vast financial sector, dragged down by the collapse of the euro. And the cost of reviving the complex economy is so high, triggering a return to the economic mayhem of the 1930s.

Catastroïka follows the global trend of privatisations in the past two decades, extrapolating the forthcoming results of the current sell-off in Greece, which has been demanded in order to face the country's enormous debts. Turning to the examples of London, Paris, Berlin, Moscow and Rome, Catastroïka predicts what will happen, if the model imposed in these areas is imported in a country under international financial tutelage...

Brussels, the capital and largest city of Belgium, has a long history of hosting the institutions of the European Union within its European Quarter; while the Union itself claims it has no capital and no plans to declare one--despite the fact that Brussels hosts the official seats of the European Commission, Council of the European Union, and European Council, as well as a seat of the European Parliament. In any event, it is here--in this centre of smoke and mirrors--that exists one of the largest concentrations of lobbyist power in the world. The Brussels Business scratches the surface of this extensive world hidden-from-view by looking at the direct influence of lobbyists and the complete lack of transparency in the decision-making processes. Speaking with lobbyists and activists themselves, The Brussels Business reveals the beginnings of a vast landscape of PR conglomerates, front companies, think-tanks and their closely-interlinking networks of power and ties to political and economic elites. The questions then become: Who actually runs the European Union? How? And why?

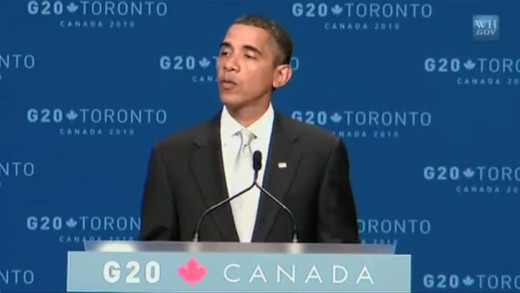

The 2008 'financial crisis' was a systemic fraud in which wealthy finance capitalists stole trillions of public dollars all over the world. No one was jailed for this massive crime, the largest theft of public money in history. Instead, the rich forced working people across the globe to pay for their 'crisis' through punitive austerity programs that gutted public services and repealed workers' rights. Capitalism Is The Crisis shows and explains this fundamental functioning of the global economy, while visiting protests from around the world against it, revealing revolutionary paths for the future. Special attention is devoted to the current situation in Greece, the 2010 G20 Summit protest in Toronto Canada, and the remarkable surge of solidarity in Madison, Wisconsin.

"Quants" are the mathematicians, software developers and computer programmers at the centre of the global economy. These are the people who designed the "complex financial products" that caused the financial crisis of 2008. Here they speak openly about their game of huge profits, and how the global economy has become increasingly dependent on mathematical models that quantify commodified human behaviours to the point of insanity. But things don't stop there. Through the convergence of economy and technology, the Quants have now brought this model into the world of the machines, where trades are done at the speed of light, far from the realm of human experience. The machines are in charge. Some Quants are even now worried. What are the risks of this complex machine? Will the Quants be able to keep control of this financial system, or have they created a monster?

With the recent global financial crisis, governments across the world promised decisive action -- the biggest financial stimulus packages in history, along with gargantuan bail-outs of corporations and floods of money into private banks and investment firms. But what crazed logic is this: propping up bad debt with…more bad debt? Overdose reviews the happenings of the bail-outs over these years, showing how dangerous the situation continues as a burst bubble is re-inflated globally. What happens next?

Inside Job provides a comprehensive analysis of the global financial crisis of 2008, which at a cost over $20 trillion, caused millions of people to lose their jobs and homes in the worst recession since the Great Depression, and nearly resulted in a global financial collapse. Through interviews with key financial insiders, politicians, journalists, and academics, Inside Job traces the rise of a rogue industry which has corrupted government and academia...

In September 2008 when the American economy was on the verge of melting down, the then-Secretary of the Treasury Henry Paulson, his former protégé John Thain (CEO of Merrill Lynch), and Ken Lewis (CEO, President, and Chairman of the Bank of America) secretly cut a deal to merge Bank of America and Merrill Lynch -- in the midst of stock collapse; a rocky merger; the worst fourth-quarter losses in at least 17 years; a stockholder revolt and an urgent need to raise more capital despite a $45 billion "bail-out" from the federal government...

By comparing the confluence of ideas about modifying behaviour using shock therapy and other forms of sensory deprivation (which culminated in the top-secret CIA project called MKULTRA during the 1950s) alongside the metaphor of similar shock treatment modifying national economics using the teachings of Milton Friedman and the Chicago School of economics, The Shock Doctrine presents the workings of global capitalism in this framework of how the United States, along with other western countries, has exploited natural and human-engineered disasters across the globe to push through reforms and set-up other mechanisms that suit those in power and 'shock' other countries into a certain wanted behaviour. Chronologically, some historical examples are the using of Pinochet's Chile, Argentina and its junta, Yeltsin's Russia, and the invasion of Iraq. A trumped-up villain always provides distraction or rationalisation for the intervention of the United States—for example, the threat of Marxism, the Falklands, nuclear weapons, or terrorists—and further, is used by those in power as more justification for the great shift of money and power from the many into the hands of the few(er).

Over six desperate days in October 1929, the New York Stock Exchange crashed leading to the collapse of three thousand banks, taking people's savings with them. In a matter of days, the United States economy was obliterated. The crash was followed by a devastating worldwide depression that lasted until the Second World War. Finances did not regain their pre-crash values until 1954. This film recounts the story of a financial disaster that we hoped could never happen again, revealing the familiar tune of cheap credit, consumerism, greed, corruption and cronyism in the current-day financial crisis...

The Chicago Sessions explores the ethical implications of the financial crisis during three sessions with a group of law and philosophy students. The grounds of the University of Chicago provide a compelling arena, since it is here that both economist Milton Friedman—staunch promoter of free market capitalism—and Barack Obama, lectured. Examples of crisis related issues discussed during the sessions are: mortgage lending practices, foreclosures, bail outs and CEO pay. The students will test their ideas both on eminent professors and on field experts. The discussion is fueled and illustrated by case stories that the students themselves provide. The cases show how the financial crisis really affects the people of Chicago and in one example shows the consequences of the foreclosures in a neighborhood not far from the university and Barack Obama's home.

Let's Make Money investigates the development of the world-wide financial system, showing that elitists economically exploit the rest of society, especially in the developing world, but also in western nations. Using the savings of a typical depositor as a case study, the film moves around the global system, showing exploitation at many levels. There are several interviews with investment managers, politicians, economists as well as homeless people and workers who give their take on the system and its impacts...

For millions of people, the global economic collapse has generated curiosity about how money systems actually work, as opposed to how they're portrayed, especially when so many financial pundits seem to be baffled. In The Ascent of Money, economist Niall Ferguson works through some history that created today's money system, visiting the locations where key events took place and poring over actual ledgers and documents, such as the first publicly traded share of a company. Viewed with a critical eye, this series aims to show how the history of money is indeed at the core of civilisation, with economic strength determining political dominance, wars fought to create wealth and individual financial barons determining the fates of millions.

Confessions of an Economic Hit Man is a presentation by John Perkins, based on the book by the same name published by him in 2004. Perkins describes the role: "Economic hit men are highly-paid professionals who cheat countries around the globe out of trillions of dollars. They funnel money from the World Bank, the US Agency for International Development (USAID), and other foreign "aid" organisations into the coffers of huge corporations and the pockets of a few wealthy families who control the planet's natural resources. Their tools included fraudulent financial reports, rigged elections, pay-offs, extortion, sex, and murder. They play a game as old as empire, but one that has taken on new and terrifying dimensions during this time of globalisation."

Money is a new form of slavery and is only distinguishable from the old slavery simply by the fact that it is impersonal--that there is no human relation between master and slave. Debt in government, corporate and household has reached astronomical proportions. Where does all this money come from? How could there be that much money to lend? The answer is that there isn’t...

Featuring George Bush's famous "go-shopping-speech" calling for a war against terrorism that deters the nation from the fear of consumption; Castro responding with hymns to the anti-consumerist, advertising-free island of Cuba; Bill Gates and Steve Ballmer preaching that the computer will give us peace on earth, and "bring people together rather than isolate them"; while Adbuster Kalle Lasn warns that advertising pollutes us mentally, that over-consumption is unsustainable, that we are running out of oil and this will cause a global economic collapse...

25 Million Pounds details the collapse of Barings Bank in the mid 1990s primarily by a broker called Nick Leeson, who lost £827 million ($1.3 billion) by speculating on futures contracts. The film contextualises the downfall as the history of Barings Bank was one of the oldest and most prestigious merchant banks in Britain, run by the same family for decades with extensive ties to Britain's elites. But in the late 19th century Barings almost went bankrupt after investing heavily in South American bonds, including backing the construction of a sewer system in Buenos Aires. The bank was saved by The Bank of England, but Edward Baring, the head of the bank, was financially ruined and never recovered. This film explores the culture of Barings and of the financial markets during the 1990s, and how Nick Leeson was able to cause another huge loss of money to the bank, this time bankrupting the company. He did this by claiming fictitious profits on the Singapore International Monetary Exchange and using money requested from London as margin payments on fictitious trades to finance his loss-making positions. It's also the profile of a stereotypical corporate psychopath, as Leeson himself explains how he was able to manipulate those around him to achieve his ends and rationalise his actions.