Obey

Obey is a video essay based on the book "Death of the Liberal Class" by author and journalist Chris Hedges. The film charts the rise of corporatocracy and examines the trending possible futures of obedience in a world of unfettered capitalism, globalisation, staggering inequality and environmental crisis -- posing the question, do we resist or obey?

The film is a video essay by Professor Albert Bartlett essentially serving as an introduction to the concept of steady growth and doubling time, by taking us through the impacts and consequences of exponential growth on a finite planet. By making good observations of this impossible growth as applied to fossil-fuel consumption, population and the endless growth of which the global economy requires, this presentation gives us the basic tools to fundamentally understand that we've got a real problem on our hands.

Nearly 100 years after its creation, the power of the United States Federal Reserve has never been greater. Governments and financial systems around the world pay close attention to the Fed Chairman's every word, philosophies and ideologies. Yet the average person knows very little about the most powerful and least understood financial institution. Money For Nothing takes viewers inside the Fed and reveals the impact of Fed policies past, present, and future.

Confessions of an Economic Hit Man is a presentation by John Perkins, based on the book by the same name published by him in 2004. Perkins describes the role: "Economic hit men are highly-paid professionals who cheat countries around the globe out of trillions of dollars. They funnel money from the World Bank, the US Agency for International Development (USAID), and other foreign "aid" organisations into the coffers of huge corporations and the pockets of a few wealthy families who control the planet's natural resources. Their tools included fraudulent financial reports, rigged elections, pay-offs, extortion, sex, and murder. They play a game as old as empire, but one that has taken on new and terrifying dimensions during this time of globalisation."

Push

Housing is fundamental human right. But in cities all around the world, housing affordability is decreasing at record pace. The local working and middle classes have become unable to afford housing in major cities: London, New York, Berlin, Hong Kong, Toronto, Tokyo, Valparaiso, Sydney, Melbourne, Caracas, Barcelona, Paris, Amsterdam, Stockholm... the list seems endless. People are being pushed out of their very own homes--because living in them has rapidly become unaffordable. Told through the eyes of Leilani Farha, a United Nations special rapporteur on housing, Push touches on the foundations of the crisis, as we follow the rise of abstract finance and the pervasive influence of neoliberalism that conjures a perfect storm: the global financial crisis of 2008--where houses packaged as "complex financial instruments" were the core of the crisis. Then, once the financial industry was bailed out by the public to the tune of trillions of dollars, financiers bought up millions of houses around the globe for cents on the dollar, and their power and influence has only increased in the subsequent decades. Farha travels all around the world, speaking to people that now spend 90% of their income on rent, after wages have stayed stagnant since 1970s, and how large corporations swallow up entire communities, guided by the same politik. She says we still need to confront those old ideas--the financialisation of the housing 'market.' "There's a huge difference between housing as a commodity and gold as a commodity." These systems don't consider the people they extract from.

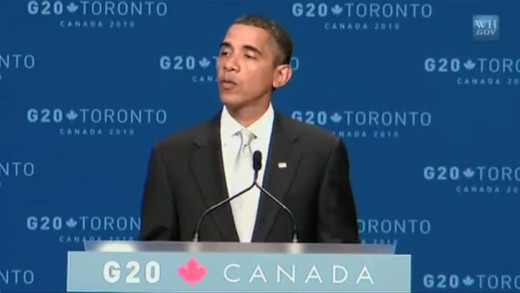

Golden Rule presents a picture of today's political economy interpreted through the framework of the "Investment Theory of political Parties". The theory, first articulated in 1983 by Thomas Ferguson, is largely based on quantitative analysis of activity in the stock market and its relationship to politics--that is to say that "elections are moments when groups of investors coalesce and invest to control the state." The film takes this theory and tests it against developments in the political and social spheres of recent decades, right up to the election of Barack Obama in the United States in 2008...

Featuring George Bush's famous "go-shopping-speech" calling for a war against terrorism that deters the nation from the fear of consumption; Castro responding with hymns to the anti-consumerist, advertising-free island of Cuba; Bill Gates and Steve Ballmer preaching that the computer will give us peace on earth, and "bring people together rather than isolate them"; while Adbuster Kalle Lasn warns that advertising pollutes us mentally, that over-consumption is unsustainable, that we are running out of oil and this will cause a global economic collapse...

For more than three decades, transnational corporations have been busy buying up what used to be thought of and known as unbuyable--forests, oceans, public broadcast airwaves, important intellectual and cultural works. Before their commodification, these commons were recognised as things in common to all people, for the benefit of all people. In This Land is Our Land, author David Bollier confronts the free-market extremism of our age to show how commercial interests have been undermining the public interest for years, and how it's become so normalised that we don't even notice it anymore. By revealing the commons within the tradition of community engagement and the free exchange of ideas and information, This Land is Our Land shows how a bold new international movement is trying to reclaim the commons for the public good by modelling practical alternatives to the restrictive monopoly powers of corporate elites.

While corporations and governments continue to disseminate globalisation and the rapacious drive for consolidation of corporate power, people around the world are pushing back to reinstate local communities. Groups are coming together to rebuild human scale, local and ecological economies based on a new paradigm of localisation and sustainability. The Economics Of Happiness documents these shifts and shows how these communities have reclaimed their autonomy...

Shifty

Shifty is a series of films that traverse the past 40 years in Britain, showing how the shift of political power to finance and hyper-individualism came together in powerful ways, to undermine one of the fundamental structures of mass democracy--the shared idea of what is real. As that fell apart, with it went the language and the ideas that people had turned to for the last 150 years to make sense of the world they lived in. As a result, life in Britain and the current and former colonies of its empire, has become strange--a hazy dream-like flux, where distrust in politicians keeps growing, and the political class seems to have lost control. Through archive footage, news reels, and on-screen-text in video essay format, Shifty documents the shapes of how this happened, using the vast ranges of footage to evoke what if felt like to live through an epic transformation during the 1980s.

With the recent global financial crisis, governments across the world promised decisive action -- the biggest financial stimulus packages in history, along with gargantuan bail-outs of corporations and floods of money into private banks and investment firms. But what crazed logic is this: propping up bad debt with…more bad debt? Overdose reviews the happenings of the bail-outs over these years, showing how dangerous the situation continues as a burst bubble is re-inflated globally. What happens next?

Dirty Money

In the late 1990s, the Reserve Bank of Australia thought it was on a winner. The bank had developed the technology to create polymer bank notes that it claimed rivalled paper money. So the Reserve Bank decided to set up a subsidiary company called Securency to sell the technology to the world. It had just one problem though—getting legitimate access to other central bank officials to pitch the idea. So instead, Securency decided to employ a shadow network of local "fixer agents" to make "connections" with relevant officials, lavishing them with prostitutes, cash, and bribing them into deals. Dirty Money is the story of this institutional corruption at the highest level of finance in Australia.

"Quants" are the mathematicians, software developers and computer programmers at the centre of the global economy. These are the people who designed the "complex financial products" that caused the financial crisis of 2008. Here they speak openly about their game of huge profits, and how the global economy has become increasingly dependent on mathematical models that quantify commodified human behaviours to the point of insanity. But things don't stop there. Through the convergence of economy and technology, the Quants have now brought this model into the world of the machines, where trades are done at the speed of light, far from the realm of human experience. The machines are in charge. Some Quants are even now worried. What are the risks of this complex machine? Will the Quants be able to keep control of this financial system, or have they created a monster?

Let's Make Money investigates the development of the world-wide financial system, showing that elitists economically exploit the rest of society, especially in the developing world, but also in western nations. Using the savings of a typical depositor as a case study, the film moves around the global system, showing exploitation at many levels. There are several interviews with investment managers, politicians, economists as well as homeless people and workers who give their take on the system and its impacts...

Skandal!

Skandal! Bringing Down Wirecard is a thriller documentary of one of the largest world-wide financial crimes. It follows journalist Dan McCrum, who reveals the inside story of a 6-year investigation into the German corporation Wirecard and the dirty tricks that were deployed against him and the Financial Times, as they battle to expose a multi-billion euro fraud at the centre of one of Germany's most successful online payment corporations of the time. The film traverses the colourful characters of the scam, such as the mafia, porn barons, gambling outfits, Libyan and Russian intelligence agencies, corporate spies, private investigators, hired thugs and surveillance operatives, demanding answers of the chief executive officer, Markus Braun, awaiting trial in Munich, and its mysterious chief operating officer, Jan Marsalek, who vanishes.

The Tax Free Tour travels the globe to expose the workings of offshore tax havens and the elite banking systems of the world's billionaires which operate in extreme secrecy. Using examples from multi-national corporations such as Apple Computer and Starbucks, the film traces sizeable capital streams that travel the world literally in milliseconds--all to avoid local laws and paying tax. Such routes go by resounding names like 'Cayman Special', 'Double Irish', and 'Dutch Sandwich'. The Tax Free Tour is a sobering look at how the world's rich live in an entirely different world than the rest of us...

Pandora’s Box

Pandora's Box -- A fable from the age of science, is a six part series examining the consequences of political and technocratic rationalism, tying together communism in the Soviet Union, systems analysis and game theory during the Cold War, economy in the United Kingdom during the 1970s, the insecticide DDT, Kwame Nkrumah's leadership in Ghana during the 1950s and 1960s and the history of nuclear power.

Controlling Interest is one of the first documentary films to provide a critical analysis on the growth of multinational corporations, and their impacts on people and the environment. Upon its release, Controlling Interest quickly became a standard audio-visual text for those concerned about the growing impact of multinational corporations, examining how the ever-increasing concentration of money and power affects employment in the United States, shapes patterns of development across the world, and influences foreign policy. This is the film that helped kick-off the anti-globalisation movement. Remarkably candid interviews with business executives provide a rare glimpse of the reasoning behind corporate global strategy, and the never-ending search for resources, ever-cheaper labour, and the commodification of life. The film documents the impact of corporate decisions on people around the world, including how "freedom" has come increasingly to mean the freedom of global corporations to operate without restriction. Some of the case studies include Massachusetts' declining machine tool industry, Brazil's "economic miracle," and Chile before and after the 1973 coup.

The Crisis of Civilization draws on archive footage and essentially monologue by author Nafeez Mosaddeq Ahmed to detail how global problems like environmental collapse, financial crisis, peak energy, terrorism and food shortages are all symptoms of a single, failed global system...

Far from ending with the abolition of slavery, the trade in human beings is thriving more than ever before. Today, 27 million men, women and children are held, sold and trafficked as slaves throughout the world. From the sex slaves of Eastern Europe to China's prison labour slaves; from Brazil's hellish charcoal slave camps to entire families enslaved in Pakistan's brick kilns, this series exposes the people behind modern slavery and the companies who profit from it.

The Mayfair Set is a four part series that studies how capitalists overtly and surreptitiously came to prolifically shape governments during the 1980s, epitomised by the Thatcher government in Britain at the time. But the corporate influence of political power doesn't simply arrive, it rather culminates after decades of engineering rooted in the economic collapse from the aftermath of the Second World War. This series focuses on the unreported and almost unseen approach that capitalists have taken since the 1940s to gradually take control of the political systems of not only the United States and Britain, but elsewhere around the world—exemplified by the boom of globalisation.

In recent years, nature conservation has become a booming business where huge sums of money change hands, and endangered species become exotic financial products. Banking Nature, delves into this hidden world of so-called environmental banking, where huge corporations such as Merrill Lynch and JP Morgan Chase buy up the land and habitat of endangered species, and then sell them in the form of shares. Companies that inevitably harm the environment are then obliged to buy credits to offset the damage that they have caused. In Uganda, we meet men who measure trees to determine how much carbon they store and then a banker from the German firm that sells the resulting carbon credits. In Brazil, the steel giant Vale destroys the rainforest, replaces it with a monocrop tree plantation, and reaps the benefits of environmental credits as if the rainforest was still standing. Banking Nature posits that we disallow the same corporate criminals responsible for the global financial crisis from turning what's left of the natural world into their final corrupt commodities market.

Catastroïka follows the global trend of privatisations in the past two decades, extrapolating the forthcoming results of the current sell-off in Greece, which has been demanded in order to face the country's enormous debts. Turning to the examples of London, Paris, Berlin, Moscow and Rome, Catastroïka predicts what will happen, if the model imposed in these areas is imported in a country under international financial tutelage...

In September 2008 when the American economy was on the verge of melting down, the then-Secretary of the Treasury Henry Paulson, his former protégé John Thain (CEO of Merrill Lynch), and Ken Lewis (CEO, President, and Chairman of the Bank of America) secretly cut a deal to merge Bank of America and Merrill Lynch -- in the midst of stock collapse; a rocky merger; the worst fourth-quarter losses in at least 17 years; a stockholder revolt and an urgent need to raise more capital despite a $45 billion "bail-out" from the federal government...

For more than two years the Eurozone has teetered on the edge of an economic precipice. But how exactly did it get into the current financial mess? Talking to historians, economists and politicians, The Great Euro Crash takes a long view of the euro--from Churchill's vision of a United States of Europe; to the bail-outs of Greece, Portugal and Ireland. Meeting a property developer in Ireland, a taxi driver in Rome and a German manufacturing worker; the film exposes the high cost being paid by European workers today for the dream of European Union—how the entire system has so far come to a complete banking meltdown. The crisis could yet claim Britain, with its vast financial sector, dragged down by the collapse of the euro. And the cost of reviving the complex economy is so high, triggering a return to the economic mayhem of the 1930s.

Filmed in Thailand and the Philippines in July 2007, Squeezed tells the story of how free trade agreements and globalisation are changing the lives of millions of people living in the Asia-Pacific region with APEC. Featuring interviews with farmers, workers and slum-dwellers, the film travels across the landscapes of Asia, from the lush rice paddies of Thailand to squatter settlements perched on a rubbish dump in urban Manila. Documenting these contrasts and contradictions, Squeezed accounts the impact of globalisation...

Dark Money tracks the influence of corporate money in contemporary politics in the United States. Using Montana as a case study, the film engages with the complex history that Montana state politics has with corporate influence. Starting with the Anaconda Copper Mining Company, Dark Money shows how the influence of mining corporations caused state legislators to relax mining regulations, which resulted in an environmental catastrophe in Butte, with problems that persist today. John S. Adams of the Montana Free Press plays a central role in the film as an investigative journalist who has been tracking state politics and following the money for several years. Adams has reported on everything from the role of the American Tradition Partnership (formerly known as Western Tradition Partnership) funds in the shaping of state election laws, to the illegal political activities of a "right to work" PAC in Montana. The film follows Adams's work as a reporter, but it also includes interviews from other prominent figures in Montana state politics and those involved in the movement to examine and limit the influence of dark money in politics.

The 2008 'financial crisis' was a systemic fraud in which wealthy finance capitalists stole trillions of public dollars all over the world. No one was jailed for this massive crime, the largest theft of public money in history. Instead, the rich forced working people across the globe to pay for their 'crisis' through punitive austerity programs that gutted public services and repealed workers' rights. Capitalism Is The Crisis shows and explains this fundamental functioning of the global economy, while visiting protests from around the world against it, revealing revolutionary paths for the future. Special attention is devoted to the current situation in Greece, the 2010 G20 Summit protest in Toronto Canada, and the remarkable surge of solidarity in Madison, Wisconsin.