Shifty

Shifty is a series of films that traverse the past 40 years in Britain, showing how the shift of political power to finance and hyper-individualism came together in powerful ways, to undermine one of the fundamental structures of mass democracy--the shared idea of what is real. As that fell apart, with it went the language and the ideas that people had turned to for the last 150 years to make sense of the world they lived in. As a result, life in Britain and the current and former colonies of its empire, has become strange--a hazy dream-like flux, where distrust in politicians keeps growing, and the political class seems to have lost control. Through archive footage, news reels, and on-screen-text in video essay format, Shifty documents the shapes of how this happened, using the vast ranges of footage to evoke what if felt like to live through an epic transformation during the 1980s.

Since the late 1980s, BBC news crews have filmed all across the Soviet Union and Russia, but only a tiny portion of their footage was ever used for news reports. The rest was left unseen on tapes in Moscow. Filmmaker Adam Curtis obtains these tapes and uses them to chronicle the collapse of the Soviet Union, the rise of capitalist Russia and its oligarchs, and the effects of this on Russian people of all levels of society, leading to the rise to power of Vladimir Putin, and today's invasions of Ukraine. The films take you from inside the Kremlin, to the frozen mining cities in the Arctic circle, to tiny villages of the vast steppes of Russia, and the strange wars fought in the mountains and forests of the Caucasus.

Push

Housing is fundamental human right. But in cities all around the world, housing affordability is decreasing at record pace. The local working and middle classes have become unable to afford housing in major cities: London, New York, Berlin, Hong Kong, Toronto, Tokyo, Valparaiso, Sydney, Melbourne, Caracas, Barcelona, Paris, Amsterdam, Stockholm... the list seems endless. People are being pushed out of their very own homes--because living in them has rapidly become unaffordable. Told through the eyes of Leilani Farha, a United Nations special rapporteur on housing, Push touches on the foundations of the crisis, as we follow the rise of abstract finance and the pervasive influence of neoliberalism that conjures a perfect storm: the global financial crisis of 2008--where houses packaged as "complex financial instruments" were the core of the crisis. Then, once the financial industry was bailed out by the public to the tune of trillions of dollars, financiers bought up millions of houses around the globe for cents on the dollar, and their power and influence has only increased in the subsequent decades. Farha travels all around the world, speaking to people that now spend 90% of their income on rent, after wages have stayed stagnant since 1970s, and how large corporations swallow up entire communities, guided by the same politik. She says we still need to confront those old ideas--the financialisation of the housing 'market.' "There's a huge difference between housing as a commodity and gold as a commodity." These systems don't consider the people they extract from.

This Is Neoliberalism is a series of video essays that explore the origins and makings of neoliberalism--the dominant ideology of capitalism. The series explains what neoliberalism is and where it came from. Economic liberalisation, privatisation of the public sphere, deregulation of corporations, tax cuts for the rich, "free trade," "austerity," and reductions in government spending in order to increase the role of the private sector in society are just some of the many themes of neoliberalism, which as an ideology, fundamentally seeks to increase the power of corporations and ensure wealth remains shifted to the upper class. The series begins in 1918, and takes us up to modern politics, through globalisation, and to the modern ruling economy.

Generation Wealth is a visual history of the materialistic, image, and celebrity-obsessed culture, explored through the work of photographer and filmmaker Lauren Greenfield. Part historical essay, part autobiographical, Greenfield puts the pieces of her life's work together to reveal the pathologies that have created the richest and most unequal society the world has ever seen. Spanning consumerism, beauty, gender, body commodification, aging, and sex, Generation Wealth unpacks the global boom-bust economy, the corrupt American Dream and the human costs of capitalism, narcissism and greed.

In Requiem for the American Dream, renowned intellectual figure Noam Chomsky deliberates on the defining characteristics of our time—the colossal concentration of wealth and power in the hands of the few and fewer, with the rise of a rapacious individualism and complete collapse of class consciousness. Chomsky does this by discussing some of the key principles that have brought this culture to the pinnacle of historically unprecedented inequality by tracing a half century of policies designed to favour the most wealthy at the expense of the majority, while also looking back on his own life of activism and political participation. The film serves to provide insights into how we got here, and culminates as a reminder that these problems are not inevitable. Once we remember those who came before and those who will come after, we see that we can, and should, fight back.

Plutocracy

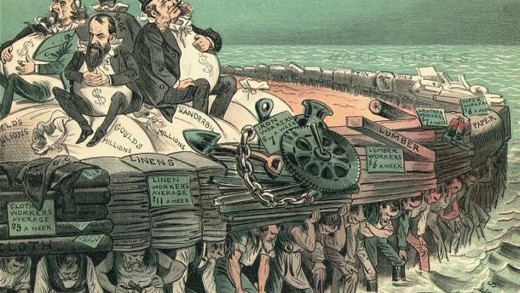

Plutocracy: Political Repression in the United States is a series of films that comprehensively examine early North American history through the lens of class, to enable a wider critique of the social order in contemporary United States. The series not only documents and exemplifies individual strikes and labour movements throughout the centuries, but also serves to connect the narratives and political lessons of an entire era from a working-class viewpoint, forming a solid base of analysis for class struggle.

Your retirement plan, if you're even lucky enough to have one, is a gamble. Fees, self-dealing, kickbacks, deregulation and/or no regulation at all brings great profits to the financial system, while imperiling the future of individuals who provide 100% of the funds, take 100% of the risks, but only get 30% of the returns. Even the privileged Baby Boomer generation now faces uncertainties, to say nothing of those who come after and face an even more staggering wealth inequality. The paternalistic "American dream" of the 1950s has long been over. Now, thanks to decades of neoliberalism, with a financial system geared towards short term profits and externalising risks and costs, the retirement fund industry is a ten trillion dollar industry, protected by obfuscation and complexity. The Retirement Gamble offers a window into this racket, raising just some of the troubling questions about how this supposed system claims to "work for everyone" when it does nothing of the sort, by design.

Six years after the housing bubble burst in the United States in 2008, the worst is yet to come. After a recent landmark settlement, major banks have lifted the freeze on foreclosures, with evictions again in full swing. Public housing budgets have been slashed, while the thin line between home ownership and homelessness grows ever more wide. People are angry about the impunity of the banks and some have found innovative ways of fighting back in an age of austerity. For Sale travels to Chicago and California to see how people at the forefront of the crisis are confronting the collapse of the American dream.

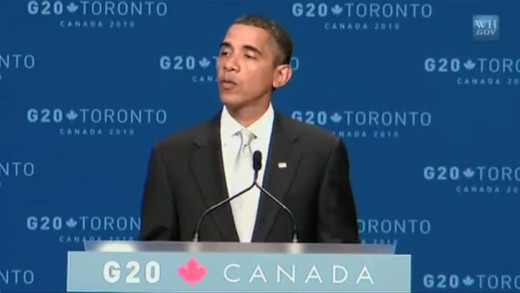

The 2008 'financial crisis' was a systemic fraud in which wealthy finance capitalists stole trillions of public dollars all over the world. No one was jailed for this massive crime, the largest theft of public money in history. Instead, the rich forced working people across the globe to pay for their 'crisis' through punitive austerity programs that gutted public services and repealed workers' rights. Capitalism Is The Crisis shows and explains this fundamental functioning of the global economy, while visiting protests from around the world against it, revealing revolutionary paths for the future. Special attention is devoted to the current situation in Greece, the 2010 G20 Summit protest in Toronto Canada, and the remarkable surge of solidarity in Madison, Wisconsin.

"Quants" are the mathematicians, software developers and computer programmers at the centre of the global economy. These are the people who designed the "complex financial products" that caused the financial crisis of 2008. Here they speak openly about their game of huge profits, and how the global economy has become increasingly dependent on mathematical models that quantify commodified human behaviours to the point of insanity. But things don't stop there. Through the convergence of economy and technology, the Quants have now brought this model into the world of the machines, where trades are done at the speed of light, far from the realm of human experience. The machines are in charge. Some Quants are even now worried. What are the risks of this complex machine? Will the Quants be able to keep control of this financial system, or have they created a monster?

By comparing the confluence of ideas about modifying behaviour using shock therapy and other forms of sensory deprivation (which culminated in the top-secret CIA project called MKULTRA during the 1950s) alongside the metaphor of similar shock treatment modifying national economics using the teachings of Milton Friedman and the Chicago School of economics, The Shock Doctrine presents the workings of global capitalism in this framework of how the United States, along with other western countries, has exploited natural and human-engineered disasters across the globe to push through reforms and set-up other mechanisms that suit those in power and 'shock' other countries into a certain wanted behaviour. Chronologically, some historical examples are the using of Pinochet's Chile, Argentina and its junta, Yeltsin's Russia, and the invasion of Iraq. A trumped-up villain always provides distraction or rationalisation for the intervention of the United States—for example, the threat of Marxism, the Falklands, nuclear weapons, or terrorists—and further, is used by those in power as more justification for the great shift of money and power from the many into the hands of the few(er).

For millions of people, the global economic collapse has generated curiosity about how money systems actually work, as opposed to how they're portrayed, especially when so many financial pundits seem to be baffled. In The Ascent of Money, economist Niall Ferguson works through some history that created today's money system, visiting the locations where key events took place and poring over actual ledgers and documents, such as the first publicly traded share of a company. Viewed with a critical eye, this series aims to show how the history of money is indeed at the core of civilisation, with economic strength determining political dominance, wars fought to create wealth and individual financial barons determining the fates of millions.

Based on the book of the same title by Juliet Schor, The Overspent American scrutinises the form of consumerism ever-pervasive in this current era that is driven by upscale spending and debt; shaped and reinforced by a media system driven by commercial interests. We're encouraged from all angles to spend money we don't have, working longer hours than ever before. Illustrated with hundreds of examples, The Overspent American draws attention to both the financial and social costs of this giant consumption machine, where the frivolous and relentless search for "happiness" and identity is espoused by advertising.

The Mayfair Set is a four part series that studies how capitalists overtly and surreptitiously came to prolifically shape governments during the 1980s, epitomised by the Thatcher government in Britain at the time. But the corporate influence of political power doesn't simply arrive, it rather culminates after decades of engineering rooted in the economic collapse from the aftermath of the Second World War. This series focuses on the unreported and almost unseen approach that capitalists have taken since the 1940s to gradually take control of the political systems of not only the United States and Britain, but elsewhere around the world—exemplified by the boom of globalisation.